Gold is often seen as a safe investment, but what does that mean for investors who want to invest in Gold? It is seen as a safe investment because it has a long history of preserving value and is rare, durable, and easy to trade. These properties make gold an ideal store of wealth.

Investors typically buy gold when they are worried about inflation or economic uncertainty. It is often used as a hedge against inflation because it tends to hold its value better than other assets.

When the economy is struggling, it can also be a good investment because it tends to perform well during periods of economic turmoil.

We’ll discuss how to invest in gold, and why it might be a good option for your portfolio. We’ll also look at some of the risks associated with investing in gold, so you can make an informed decision about whether this asset is right for you.

How is the price of gold determined on the global marketplaces, and what factors influence its value over time?

The global gold market is complex, with many factors influencing the price of gold at any given time. The most important factor in determining the price of gold is demand from buyers, which is influenced by a wide range of factors including economic conditions, geopolitical developments, and jewelry demand. Other important factors include the availability of supply, which can be impacted by mine production levels and scrap recycling, and central bank activity.

Gold prices are typically quoted in U.S. dollars per troy ounce (oz). One troy ounce equals 31.1 grams. Prices are also sometimes quoted in other currencies such as euros or Japanese yen.

The main drivers of gold demand are jewelry demand, investment demand, and central bank activity.

Common Methods to Directly and Indirectly Invest in Gold

There are many ways to invest in gold, both directly and indirectly. The most common direct investment vehicle is gold bullion, which can be purchased in the form of coins, bars, or rounds. Gold ETFs and mutual funds are also popular options for investors looking for indirect exposure to the metal. Some investors also opt to invest in companies that are engaged in gold mining or other aspects of the gold industry.

How to Invest in Gold?

Invest in Gold Bullion

Gold is very accessible to the common investor, unlike other popular commodities. An individual can buy gold bullion in bar or coin form, from a brokerage, bank, or precious metal dealer.

Bullion bars are usually available in a wide range of sizes, from a quarter-ounce to a 400-ounce bar.

Buying gold bullion gives you the satisfaction of having to look at and even touch your precious possession. However, ownership tends to have some major drawbacks, especially if you own more of it. One of the main risks is the need to protect and ensure the gold and the need to pay for storage if buying in large quantities.

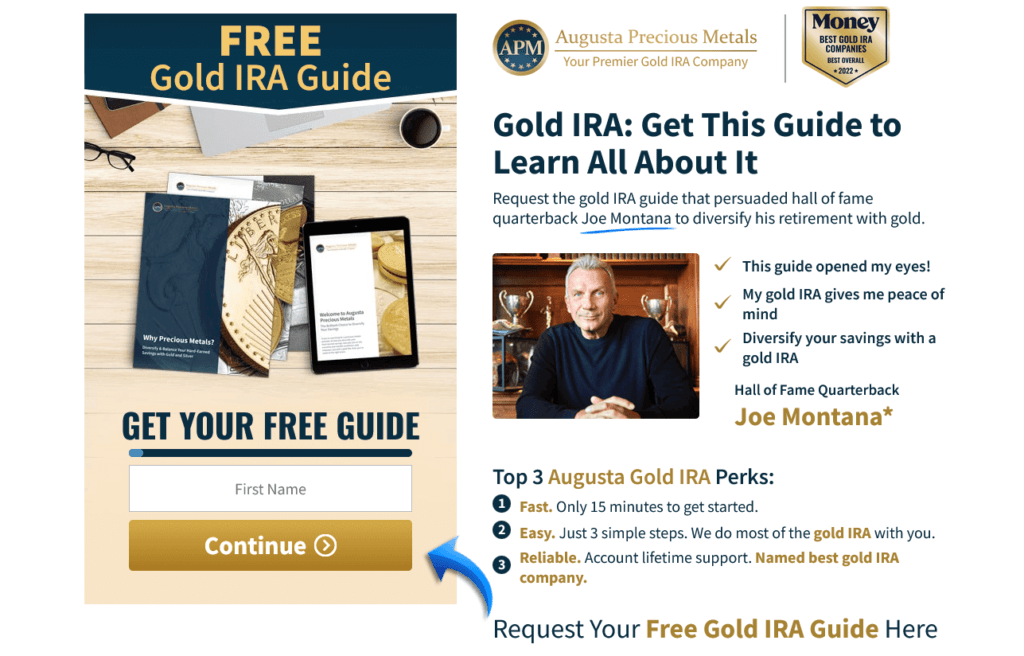

You can buy gold bullion in different ways – from a local collector, dealer or via specialist gold ira companies who are able to provide a wide range of information to ensure that you are aware of your options such as rolling over a 401k to gold or buying gold with an IRA.

It is important to note that gold bullion can sometimes refer to bulk gold – ingots or bars. The difference between the two is that ingots are pressed while bars are usually poured. When buying bullion, make sure your gold is stamped with weight, purity, where it was minted, and its origin.

Invest in Gold coins

Gold coins are another popular way of purchasing gold. These coins are minted by the governments specifically for investors.

Their prices differ based on gold content or ‘melt value’ as well as a 1% to 5% premium. There are many kinds of gold coins, however, for maximum liquidity, investors usually stick with the following widely recognized and circulated gold coins:

- American Gold Eagle

- Canadian Maple Leaf

- Australian Gold Nugget

- South African Krugerrand

Minted coins can be purchased from coin dealers, major banks, precious metal dealers, or brokerage companies.

Invest in Gold Jewelry

Adding gold jewelry to your portfolio can be a smart move. Some investors, especially in Europe and Eastern countries have extensive collections of gold jewelry.

One of the reasons why this is one of the most popular ways to buy gold is because they have a high global market demand. Moreover, you don’t need to sweat about storage as you can wear it on your body.

It is important to ensure that the jewelry you are buying is from an authentic and trustworthy supplier. Many novice investors tend to fall for fake jewelry because some brands offer gold-plated or costume jewelry while labeling it as authentic pure jewelry.

Fortunately, there is a way you can avoid this mistake. All reliable online gold jewelers have Assay Assured certification. Also, be sure you purchase your jewelry from a retailer that offers returns.

Buying Gold Miners Stock

Purchasing shares of a gold refining or mining company or any other aspect of the production business is also another way of investing in gold. Most of these companies are listed on stock exchanges around the world and their price per share usually reflects the movement of gold itself.

But the return and growth in each stock will depend on the expected future earnings of the business, and not just the overall value of gold.

Generally, buying mining stocks presents you with two ways to profit in gold – if the price of the metal rises and if the company raises production.

Invest in Gold ETFs

Instead of digging deep into each gold mining company, you can simply buy a gold ETF. This can be a great option if you are more conservative when it comes to investing. Gold-backed exchange-traded funds tend to directly invest in physical gold, so you will still get exposure to precious metals.

Gold Mutual Funds

Often used interchangeably is gold-oriented mutual funds. The difference between ETFs and mutual funds is that ETFs invest in physical gold while mutual funds can invest in stocks and physical gold.

Many investors prefer gold mutual funds to ETFs because gold stocks tend to rise and fall more quickly than the price of actual gold. While this is a risk you need to be aware of, ETFs present appreciation potential, which lacks in bullion.

Investing in Gold with Futures and Options

Seasoned investors tend to consider options on gold ETFs or options on gold futures. With this contract, you have the right and not the obligation to sell or purchase gold at a defined price for a specific amount of time. You can use options if you think the price of the precious metal is going down or up.

If you misjudge the market, the maximum risk involved is the premium you incur to enter the option contract.

Protecting your Investment in Gold and Associated Risks

Gold is a valuable asset, but it is also important to remember that the price of gold can be volatile and that there are risks associated with any investment.

Gold is often seen as a safe investment, but there are several risks associated with investing in gold.

1. Gold is a physical commodity, so it is subject to the vagaries of the marketplace. The price of gold can be volatile, and investors may not always be able to sell their gold at a profit.

2. Gold is also a currency, and as such, it is subject to inflationary risks. If the value of the US dollar declines, the price of gold will likely increase. However, if inflation increases, the purchasing power of gold will decrease.

3. As gold is often bought as a hedge against economic uncertainty, it may not perform as well as other investments during periods of stability or growth.

4. There are storage and insurance costs associated with owning gold. Gold bars and coins must be stored in a safe place, and this can be expensive. Additionally, insurance costs can add to the overall cost of ownership.

5. Finally, gold does not produce income. Unlike stocks or bonds, gold does not pay dividends or interest. This means that investors must rely on capital appreciation to achieve a return on their investment.

For these reasons, it is important to carefully consider the risks before investing in gold. While it may offer some protection against economic uncertainty, there are also potential drawbacks that should be taken into account.

Benefits of involved to Invest in Gold?

Gold has a number of unique characteristics that make it an attractive investment. For example, gold is a durable asset that is not subject to the same kinds of price fluctuations as other assets such as stocks or bonds. Gold is also portable and easy to store, making it an ideal asset for investors who are looking for a safe haven in times of economic or political turmoil. Additionally, gold has historically been a good hedge against inflation, which can erode the purchasing power of other assets over time.

When considering an investment in gold, it is important to understand both the potential risks and rewards associated with this type of asset. While there are no guarantees when it comes to investing, understanding the potential risks and rewards can help you make an informed

Summary

Gold is one of the few assets that guarantee sustained returns. It has been a valuable resource for thousands of years and is still seen as a safe investment option. While there are many pros and cons of investing in gold, as with any other form of investment, if you are thinking about investing in gold, it is important to do your research and understand the potential risks involved before making a decision. Many gold ira companies can offer valuable advice on the various options and they also offer free investment guides to provide essential information on how to get started.