Retirement planning is an important process for ensuring that you have the financial resources to live comfortably in retirement. There are a number of factors to consider when retirement planning, including your retirement goals, your current financial situation, your retirement income sources, and your retirement expenses.

One of the first steps in planning or your retirement is to determine your retirement goals. Do you want to retire as soon as possible? Do you want to maintain your current lifestyle in retirement? Or do you want to retire early and travel the world? Once you know your retirement goals, you can start to develop a plan to achieve them.

Your current financial situation is another important factor to consider when retirement planning. Do you have any outstanding debts? How much savings do you currently have? What is your current annual income? Knowing where you stand financially will help you determine how much money you need to save for retirement.

Your retirement income sources will also play a role in your retirement planning. Will you rely solely on Social Security benefits? Do you have a pension from your employer? Do other sources of income, such as rental property or investments? Knowing how much income you can expect in retirement will help you develop a realistic budget.

Finally, your retirement expenses will need to be taken into account when retirement planning. How much do you currently spend each month on housing, food, transportation, and other essentials? What leisure activities do you enjoy that may cost more in retirement? Estimating your monthly retirement expenses will help you ensure that your nest egg lasts as long as you need it.

Is There a Safe Option for Investing for Retirement?

When investing for retirement, there are usually three safe options:

- Invest your funds in a traditional retirement account offered by your employer, such as a 401k or 403b. These plans are often a safer option as the money will compound tax-free until the time you decide to withdraw it in retirement. You can avoid taxes either on the funds you withdraw from your plan or the money you add into the plan. The former depends on whether you use a Roth or Traditional retirement account option.

- The second safe option involves putting your investment into your own tax-advantaged retirement account, like an IRA. Traditional IRAs often offer similar tax breaks just like 401ks, although there is small a difference when it comes to eligibility conditions.

- The last option for investing in retirement is putting your money into a traditional investment account that does not have tax advantages.

All three are among the safest option for investing for retirement, although the first two offer better deals. It is important to note is that there are limits on the amount of money you can put into an employer-sponsored retirement plan or tax-advantaged retirement account.

If you have invested to the limit allowed in a tax-advantaged retirement plan of your choice, but you still want to save more – maybe you started saving for retirement late – an option is a traditional investment account.

The Importance of Retirement Planning and Investment Diversification

In the world of investing, diversification is an approach that aims to maximize returns and mitigate risk by allotting investment funds across various industries.

Diversifying with an industry or a sector involves, for example, buying railroad stocks to protect yourself against the damaging changes to the airline sector. In this case, you are investing in the transportation industry and holding different positions within the same industry. You can also diversify across companies, asset classes and borders.

Diversifying your investment aims to protect against potential losses. This can be important for older investors looking to preserve their wealth for retirement. It is also beneficial for individuals approaching their retirement who may not have a stable stream of income.

Diversification can also help enhance the risk-adjusted returns of your portfolio, giving you a chance to earn greater returns when factoring in the risk you are taking. You may also be more likely to earn more through riskier investments, but with a risk-adjusted return, you can see how well your capital is being used.

How to Manage Risk with Your Retirement Savings?:

All investments come with some risk levels, so it is important to minimize this risk as much as possible. Understanding the risk factors associated with your investment can help you move a step closer towards your retirement goals. There are four major risk factors you need to manage with your retirement savings. They are longevity, inflation, market volatility, and a withdrawal strategy.

Managing these risk factors will increase your chances of having readily available funds when you reach retirement.

One of the best ways to manage risk is diversification. If you own a single stock in your portfolio, you are subject to the risk of poor management of the company. To avoid this, you can diversify across different stocks in the same industry, but you will still be susceptible to business or industry-specific risk.

You can diversify against business risk by building a portfolio of stocks across multiple industries.

Retirement Planning Options?:

Retirement Savings Accounts

Investing part of your savings in the right savings account is one of the many options to diversify your portfolio. This is also the best place to keep ready cash or funds you are accumulating for short-term objectives, such as your next vehicle or summer vacation.

Retirement Savings Accounts (RSAs) are a type of savings account that offers tax benefits to encourage people to save for retirement. Contributions to RSAs are made with after-tax income, but the money in the account grows tax-free and can be withdrawn tax-free in retirement. There are two main types of RSAs: Traditional RSAs and Roth RSAs.

Traditional RSAs offer a tax deduction for contributions, while Roth RSAs grow tax-free but do not offer a tax deduction for contributions. Both types of RSAs have income limits and contribution limits. For example, in 2020, the contribution limit for traditional and Roth RSAs is $6,000 per year (or $7,000 per year if you’re age 50 or older).

Once you reach retirement age, you can start withdrawing money from your RSA. Withdrawals before retirement age are subject to taxes and a 10% penalty.

Another type of retirement savings account is the 401(k), which is offered by many employers. Retirement savings accounts have a number of advantages, including tax breaks and the ability to grow your money over time. However, there are also some drawbacks to consider, such as high fees and early withdrawal penalties. When it comes to saving for retirement, there is no one-size-fits-all solution.

Retirement Savings Accounts can be a great way to save for retirement, but it’s important to understand the rules and regulations before opening an account. Ultimately, it’s important to do your research and choose the option that will work best for you.

Employee Savings Plans

An employee savings plan is a type of retirement savings plan that allows employees to set aside money for their future. There are many different types of employee savings plans, but they all have one common goal: to help employees save for their retirement.

Employees can contribute to their employee savings plan through payroll deductions, and the money is then invested in a variety of different assets such as stocks, bonds, and mutual funds. employee savings plans are a great way for employees to save for their retirement, and they offer many benefits such as tax breaks and employer matching contributions. It is a safer option when looking for a way to save for your retirement.

Fixed Annuities

A fixed annuity offers almost guaranteed retirement income payments. It is a type of annuity contract that offers a guaranteed return on contributions you make over a specific period or as a lump sum.

The period of making contributions to a fixed annuity is called the accumulation phase, while the period of making withdrawals is known as the distribution phase.

With this contract, you make several payments or a lump sum to the annuity provider, and in return, you get paid a fixed return on your contributions, regardless of how the markets perform.

A fixed annuity can be a great investment if you want to have a reliable income stream after retiring. They are basically insurance products rather than an equity investment with high growth, making it a good balance to an investment portfolio for individuals in or nearing retirement.

Dividend Stocks

Dividends can be used to build passive income in a financial portfolio or simply to grow wealth. Dividend-paying stocks from low-risk but high-quality companies are an ingenious way to create a steady and reliable income stream for your retirement.

Stock dividends usually grow over time, and therefore, the cash flow from the dividend payments can help supplement your pension or social income. In some cases, it can even supply all the money you need to support your retirement lifestyle.

Since stock dividends grow over time, it is important to have stocks as part of your retirement investment portfolio.

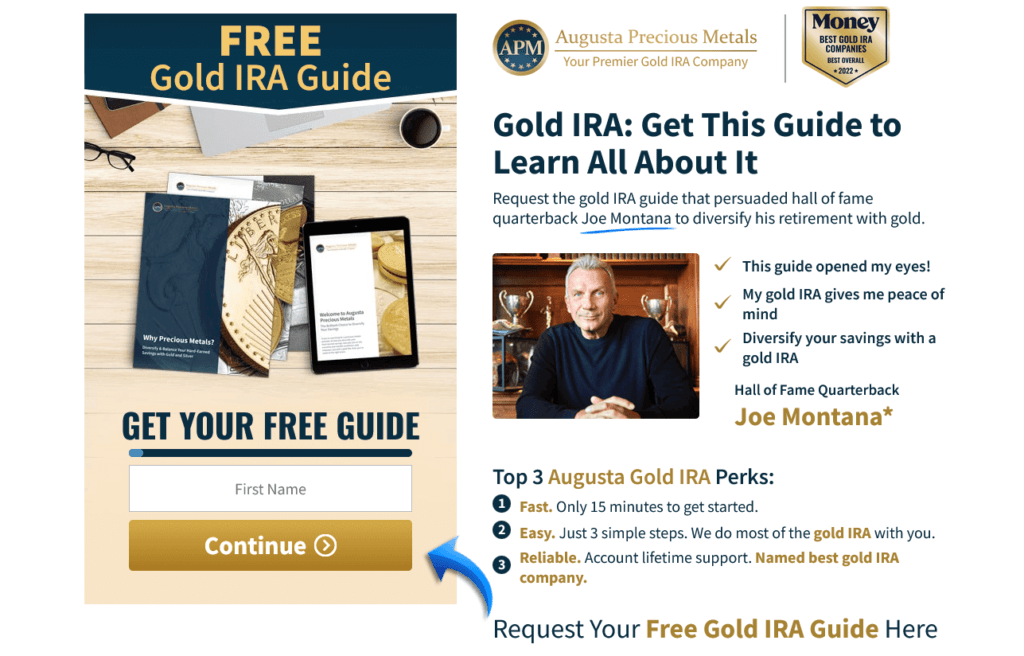

Precious Metals

Depending on the financial situation you are in, many finance experts have recommended that a retirement investment portfolio comprises at least 5% precious metals. Gold and or silver are the more popular options.

Examples on how to invest in gold and silver for your retirement:

- Buying physical precious metal in an IRA: With this method, you set up a precious metal IRA, such as a traditional IRA, and use it to buy and hold physical gold and silver. Although it involves more paperwork, it usually offers good massive tax benefits.

- Buying physical precious metal outside IRA: If you want to store your own silver and gold, you can buy using non-precious metal IRA. With this account, you can buy any physical asset you want and store it yourself.

- Purchasing paper gold in 401k or traditional IRA: Paper gold is a holding of gold that intangible. This can be gold or silver ETFs, precious metal mining stocks, or gold and silver futures contracts.

Gold IRA Rollover Options

A gold IRA is a retirement savings plan that allows you to invest in gold, silver, and other precious metals. Unlike a traditional IRA, which is managed by a financial institution, a gold IRA is self-directed, which means you have more control over your investment choices.

If you choose to buy gold in an IRA, you have two rollover options – direct and indirect. With a direct rollover, money from your retirement account is automatically transferred to the IRA, while in the case of an indirect rollover, you transfer money from your retirement account and then put it into your gold IRA account.

When setting up a gold IRA, you will need to choose a custodian and an administrator for your account. The custodian will hold the asset (in this case, the gold) on your behalf, and the administrator (usually a gold ira company specialist) will manage the account and keep track of your transactions. Before making any decisions, be sure to research the fees and commissions associated with each option to ensure you are getting the best deal possible.

Managing a 401k Rollover to Gold

A 401k rollover to gold can be a great way to diversify your portfolio and protect your retirement savings. When you roll over your 401k, you have the option to invest your gold in a tangible asset that can be stored in a safe deposit box or at a private vault.

If you’re interested in rolling over your 401k to gold, there are a few things you need to know. First, you’ll need to check with your 401k plan administrator to see if this is an option. If it is, you’ll then need to open a gold IRA account. Once your account is opened, you can transfer your 401k balance into it. You’ll need to pay taxes on the rollover, but will also be able to avoid penalties.

With a gold IRA, you’ll have the flexibility to invest in gold coins, bars, or ETFs. This can give you the opportunity to diversify your retirement portfolio and hedge against inflation. Rolling over your 401k to gold can be a good way to protect your retirement savings and maximize your long-term growth potential.

There are many benefits to rolling over your 401k to gold, including potential tax breaks and the ability to hedge against inflation. However, there are also some risks to consider, such as the volatile nature of the gold market. Before making any decisions, it’s important to speak with a financial advisor to see if a 401k rollover to gold is right for you.

Real Estate

A popular investment that is good for retirement is real estate. Many people have used it to create a comfortable lifestyle, and it is an excellent option for retirement as you can have a monthly income in addition to holding a powerful investment asset.

There are plenty of investment options in real estate, but a basic rental property is the most popular. In this approach, you purchase a property with a high regular rental income, and every month you earn income that you can transfer to your pension scheme for retirement.

Another option to invest in real estate is through a real estate investment group. These groups operate similarly to mutual funds but for rental properties. If you prefer to rent a property without the hassle of managing the property, a real estate investment group can be an ideal solution for you. In this case, a company will build or buy apartments and let investors buy them via the company.

A real estate investment trust is another popular investment option in real estate. If investing in regular real estate is too expensive for you, a Real Estate Investment Trust provides you with an opportunity to invest small amounts – like shares.

The Bottom Line for Retirement Planning

The best strategy to use to secure your financial future is through diversification. By diversifying your investment, you lower the risks by spreading your capital within, and across multiple asset classes such as dividend stocks, real estate, savings accounts, and precious metals. It is one of the surest ways to weather the ups and downs of the market and maintain the chance for growth.

Disclosure: We may receive a referral fee if you click on a link or image featured in this article. The content provided is not a financial advice and we recommend referring to a professional for investment advice.